Zeki Data 最新報告闡述深度科技生態系統內的競爭情況

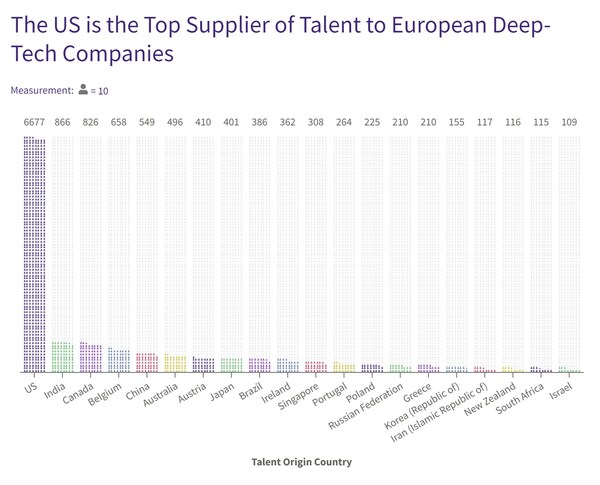

倫敦2024年9月25日 /美通社/ — Zeki Data 今日發表的深度科技 (Deep-tech) 人才全球報告顯示,美國的深度科技公司數量是英國的 3 倍,而歐洲小型創業公司的先進技術人才集中度遠高於北美。

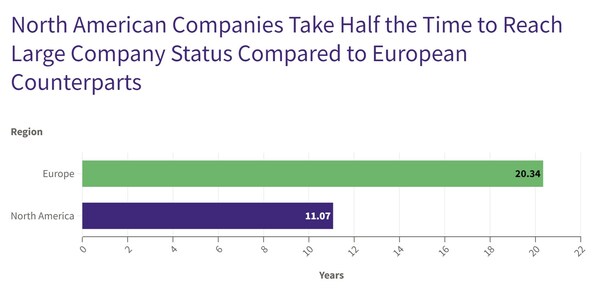

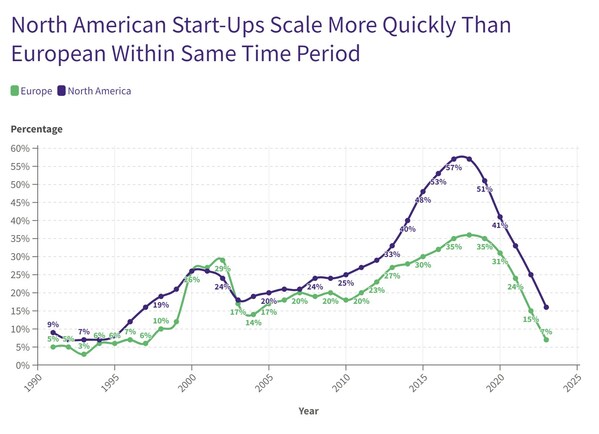

North American Startups Scale 2x Faster than European: Deep-tech startups in the United States are scaling twice as fast as European counterparts.

The Deep-Tech Talent War: Europe vs. North America Showdown 2024 Report 以人才為主角,揭開歐洲與北美之間深度科技的基本趨勢。報告顯示自 2020 年以來,新的深度科技公司的發展速度大幅放緩。

Zeki Data 是一間總部位於英國的深度科技數據公司,總部設在英國的深度科技數據公司,為深度科技公司的未來潛力進行評分,以指導投資和人才招募。Zeki Data 在報告中顯示,國家正意識到,吸引和留住人才,是在轉型科技領域建立主權能力的關鍵,這些科技將為下一階段的國家繁榮和安全奠定基礎。

Zeki Data 行政總裁暨共同創辦人 Tom Hurd 表示:「深度科技公司需要有限的科學與工程人才以落實其創新策略,因此競爭非常激烈。政府正在向深度科技初創企業投入資金,以確保創新優勢;然而 Zeki 的數據顯示,在資本成本高企和市場整合的逆風中,投資報酬率相當有限。」

Hurd 補充說:「吸引和留住創新人才,是深度科技公司未來創新潛力的最佳指標。這應該是國家和公司的首要任務。」

《Deep Tech Talent War》報告,就研究數據較少的 6,100 多間最重要的歐洲和北美深度科技公司,集中分析這些公司的演變以及其競相掌握新科技的戰略意義。Zeki 研究了這些公司在全球僱用的 8,795,902 名員工,尤其是 227,948 名擁有先進技能的人士。

zeki 數據報告的主要發現

1.政府投資未能促進初創企業增長:自 2020 年以來,新的深度科技公司成立速度,在歐洲和北美洲大幅放緩。為了帶動深度科技的創新步伐,各國不遺餘力地投入大量資金。高資本成本與市場整固的逆流,削弱了政府工業政策的效果。

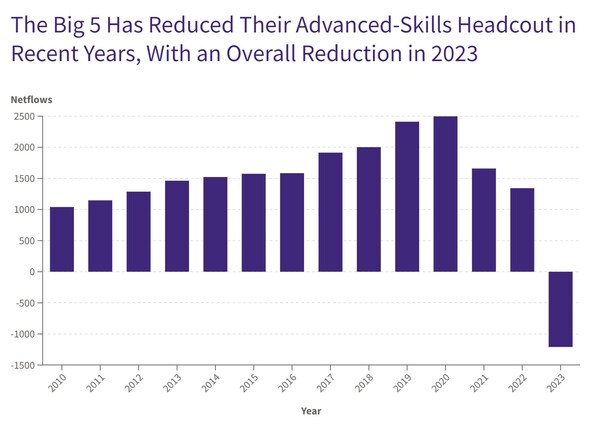

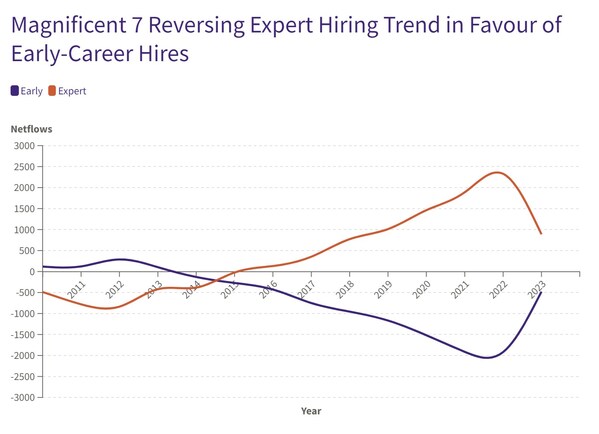

2.美股七巨頭 (Magnificent 7) 優先聘用低成本員工:GenAI 驅動的市場整合,正在帶動 Amazon、Apple、Google、Meta、Microsoft、Nvidia 和 Tesla的巨大招聘轉變。深度科技公司正在偏好早期職業生涯、降低成本的招聘,並減少更高成本的經驗。

3.美國初創企業的擴展速度比歐洲快 2 倍:美國深度科技初創企業的擴展速度,是歐洲同業的兩倍。

4.工程生物學公司努力擴展:工程生物學公司仍然不失為具吸引力的收購目標,因其努力發展成為中型和大型企業。

5.電池技術已經崩潰:在 2019 年開始的綠色能源人才出走潮之前,可再生能源已不受人才青睞:自 2022 年以來快速撤離此行業的員工足以證明這一點。

6.軟件工程發展如日方中:半導體、航空航天和國防公司正在爭奪頂級軟件工程人才,而大部分網路安全產業似乎都將銷售優先於軟件人才。

7.中國人才撤離西方:在國家層面上,中國的深度科技人才正加速從西方公司外流。對於離開歐洲和北美高科技公司的中國人才而言,中國已成為其首選目的地,沒有其他地方可以相比。

完整的報告可在 zekidata.com/Talentwar 免費下載

Zeki Data 簡介

Zeki Data 是一間總部位於英國的深度科技數據公司,評分深度科技公司的未來潛力,為相關投資和人才招聘作出指導。Zeki 的數據來自超過 1000 萬位領先的科學家、工程師和研究人員,專門從事人工智能、量子計算、數據工程、半導體和健康科技等頂尖領域。組織利用 Zeki 數據來優化其人才招聘流程和創新渠道,並發掘個別公司創新的品質、動力和未來方向的新量化洞察力。

我們開發了 20 個定制指標以評估每位專家,詳細描述其專業領域,並評估其專業影響、技術能力、職業軌跡、期望前景、聲譽和未來潛力。我們的客戶群涵蓋投資者、企業策略師、人力資源團隊和政府機構,所有人都運用 Zeki 的洞察力,在不斷推陳出新的科技環境中屹立不倒。

了解更多資訊,請瀏覽 www.zekidata.com

New company formation since 2000 has been the same in North America and Europe. However, when we look at the annual growth rates of hiring advanced-skilled, deep-tech talent, North American companies have scaled much faster than their European equivalents.

Historically, deep-tech companies have been the main destination for global talent with advanced skills. However, this is not the case in recent years, with a dramatic drop in numbers joining deep-tech companies in the past two years.

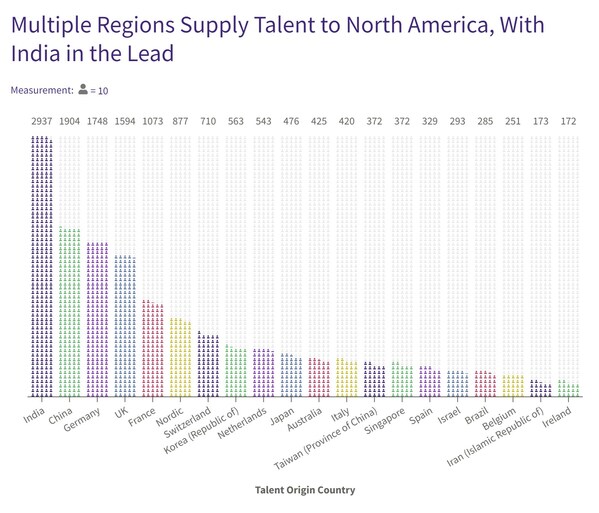

North American companies can attract European nationals, especially those specialising in AI, although this has tailed off in recent years. However, the main alternative source of talent for North American companies is India, and to a secondary extent, China, and wider Asian countries.

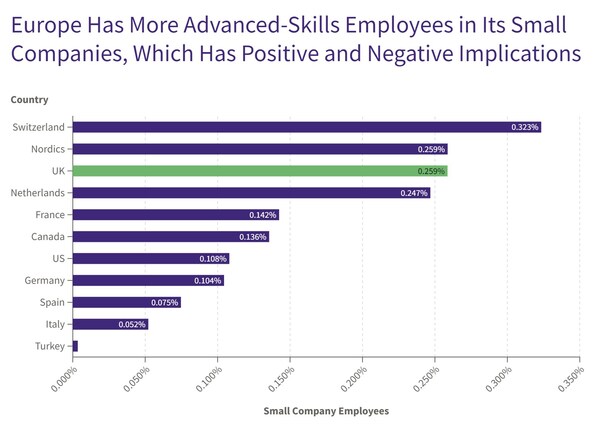

Europe shows a much higher percentage of small companies and attract up to three times more of the productive pool of advanced-skills, deep-tech talent in their country of origin than in the US. However, this is a mixed blessing as European governments increasingly execute industrial policies to promote deep-tech at home, they run the risk of creating ‘zombie start-ups’: employing finite, hard-to-find human resources while increasing relying on government support.

This shift to hiring early-career talent reserves a trend across the Magnificent Seven going back to 2014. It is also a general trend across deep-tech as companies, for different reasons, seek to make the most efficient use of free cash flow as they face new challenges after the COVID-19 pandemic, be they technical or financial.